Stress Management in a Down Market

I hope everyone had a turkey filled and relaxing Thanksgiving, I know I’m planning on working leftover turkey into my meals for weeks to come. I write a fair amount about how to reduce stress in investing and focus on making smart investment decisions, but I wanted to talk about this concept in a down market. If you’ve been paying attention to the market recently (and if you haven’t, seriously congratulations, I’ll get to that in a bit) you’ll have seen that a lot of the numbers are red more often than not. My advice about staying the course is all well and good when the markets are up and you’re making money, but things get a little more murky when the market actually begins to dip. So, let’s take a look at logical steps to take when a downturn hits and then ways to calm the illogical thoughts/actions that can pop up.

Strategy

The first step when a down market hits is to check in with your investment strategy. I don’t mean you should go back and completely redo everything and change all of your investments but simply to look at your strategy while incorporating this new information. When a down market hits, it gives you new information that should be considered when looking at any type of investment strategy. A downturn in the market gives you an opportunity to evaluate the work you’ve done and check in to see if your strategy still fits with the goals you’ve laid out for yourself. Any good long term strategy will have accounted for downturns in the market, whether they’re brief or protracted, but this serves as a great time to check in with the strategy at a high level.

The second step is to make sure you’re broadly diversified across the globe. If you’ve read this blog consistently (or picked any single entry at random) you know my thoughts on the importance of broad diversification. By investing in more than just US index funds, you are able to mitigate some of the losses when the markets dip by having other sectors and countries pick up the slack. If you are not diversified in your strategy, then this time of volatility may be a good sign that it could be beneficial to reallocate your investments. This is where the strategy of “I’ll just invest in the S&P 500 index fund” may come back to bite you. I know that it’s low cost and very easy to manage, but when market downturns hit it can be a bigger slice of your assets that get taken away. All of this is great to remind yourself of when things head south, but it can be difficult to think through things when a good chunk of your money gets lost to the market. In that case, let’s look at some ways to prepare for the emotional reactions to a down market.

Stress Management

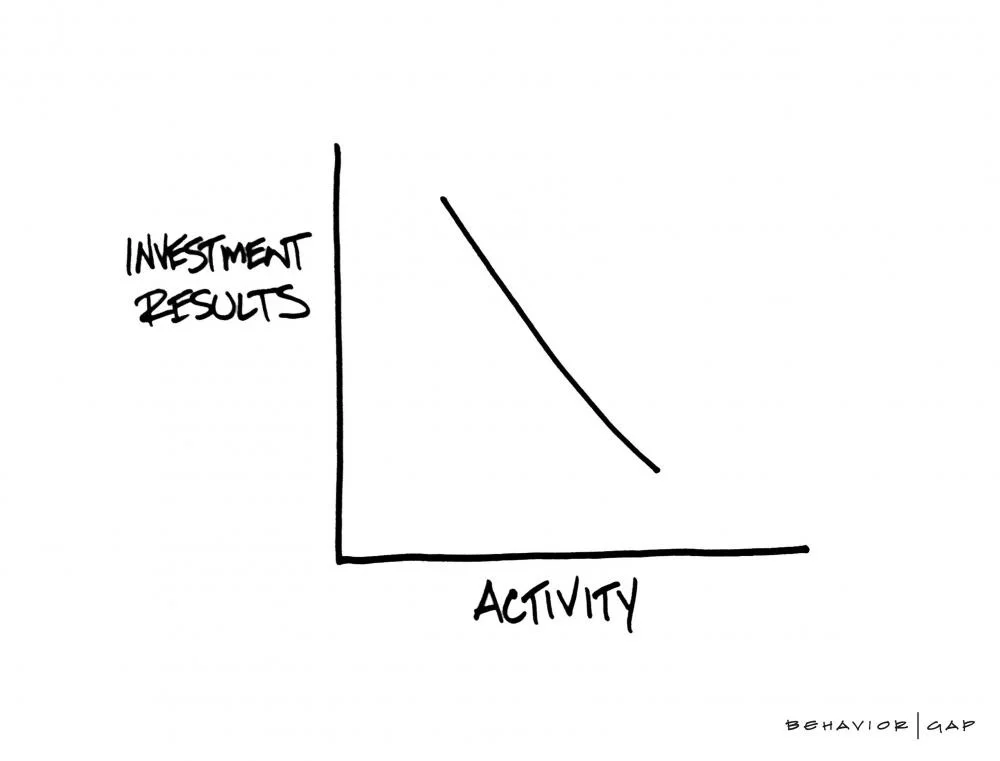

For those of you who were invested in the market when 2008 hit, you’ll remember that feeling you had when you checked your accounts and saw thousands of your dollars simply disappear. I’m guessing there were many thoughts running through your head and very few of them were “I should reevaluate my strategy to make sure it still fits my goals and make sure I’m globally diversified”. That’s because very few people think like that and because there is a lot of emotions surrounding the topic of money. So how do we reduce stress in these situations? One of the easiest ways is to not pay attention to the market. Very rarely does the “stick my head in the sand so I can’t see the danger” strategy work, but it can actually be beneficial in this instance. If you know your strategy still works towards your goals, and you have broadly diversified your investments, then not paying attention the movements of the market can help reduce the time worrying about your investments. Being active in the market and making changes usually leads to reduced returns on your investments.

Throughout the entire history of the stock market, the general trend has been going up. There have certainly been pockets of time where it went down consistently, but over the long term it went up. Fort those who are looking for shorter term investments or who don’t have a long time horizon, you will need to more carefully analyze your strategies and make sure you’re not going to be losing money that you were counting on for retirement. But for those who aren’t planning on needing their investments for the next 15, 20, 30 years then this can be a great way to approach the market. You will be able to avoid giving into the fear of losing all your money so you will be able to avoid the pitfall of making changes and increasing your activity. By not checking your accounts daily you can easily avoid many of the mistakes people make by being ruled by the day to day market volatility.

Obviously this approach won’t work for everyone, so what about those who can’t just turn off their brain that’s constantly thinking about potential losses? I know this will sound like pandering, but you should call your financial advisor. If you work with someone like myself and have trusted them to invest your money then you’re paying them to walk you through situations like this. It is our job to provide objective advice during tough situations such as downturns in the market. Hopefully whoever you’re working with has prepared you for this situation and is proactive in reaching out to you, but you should never be hesitant to reach out to them with questions or to get reassurance. Money and finance are emotional topics and that can be very detrimental when we’re not prepared for the irrational feelings that surface when things aren’t always looking up. Nobody likes market downturns, but if you’re well prepared you can survive them and come out the other side with a positive investment experience.

These are some of the actions and strategies you can use to cope with market downturns. If you are concerned about the way the markets are heading or have questions on how you can have a positive investment experience despite these setbacks, please reach out to me. I’d be happy to talk about your strategy, goals, and ways to reduce your stress during a volatile market.