Financial Literacy Friday: Market Cycles

Today’s edition of Financial Literacy Friday looks at the concept of market cycles and how they give structure to the volatility in our markets. Market cycles describe the trends that present during different business environments which means that when some companies underperform others over-perform depending on the type of business. These cycles can affect only particular segments of the market, technology companies for instance, or they can have widespread influence on markets as a whole. So for today, we’ll quickly look at the 4 major phases of market cycles and then discuss what this means for those who are thinking about investing.

Market Cycle Phases

There are a few different names for each phase, but we’ll be calling them accumulation, mark-up, peak, and trough. Let’s take a look at what happens during each phase.

Accumulation: This is the phase that occurs after the market has bottomed out and many people without a strategy have given up and sold their investments for a loss. For more experienced investors this is the time to start buying up stocks as most can be purchased for a discount at this point. The news will continue to preach that “This is the end!!” even as the market begins to flatten.

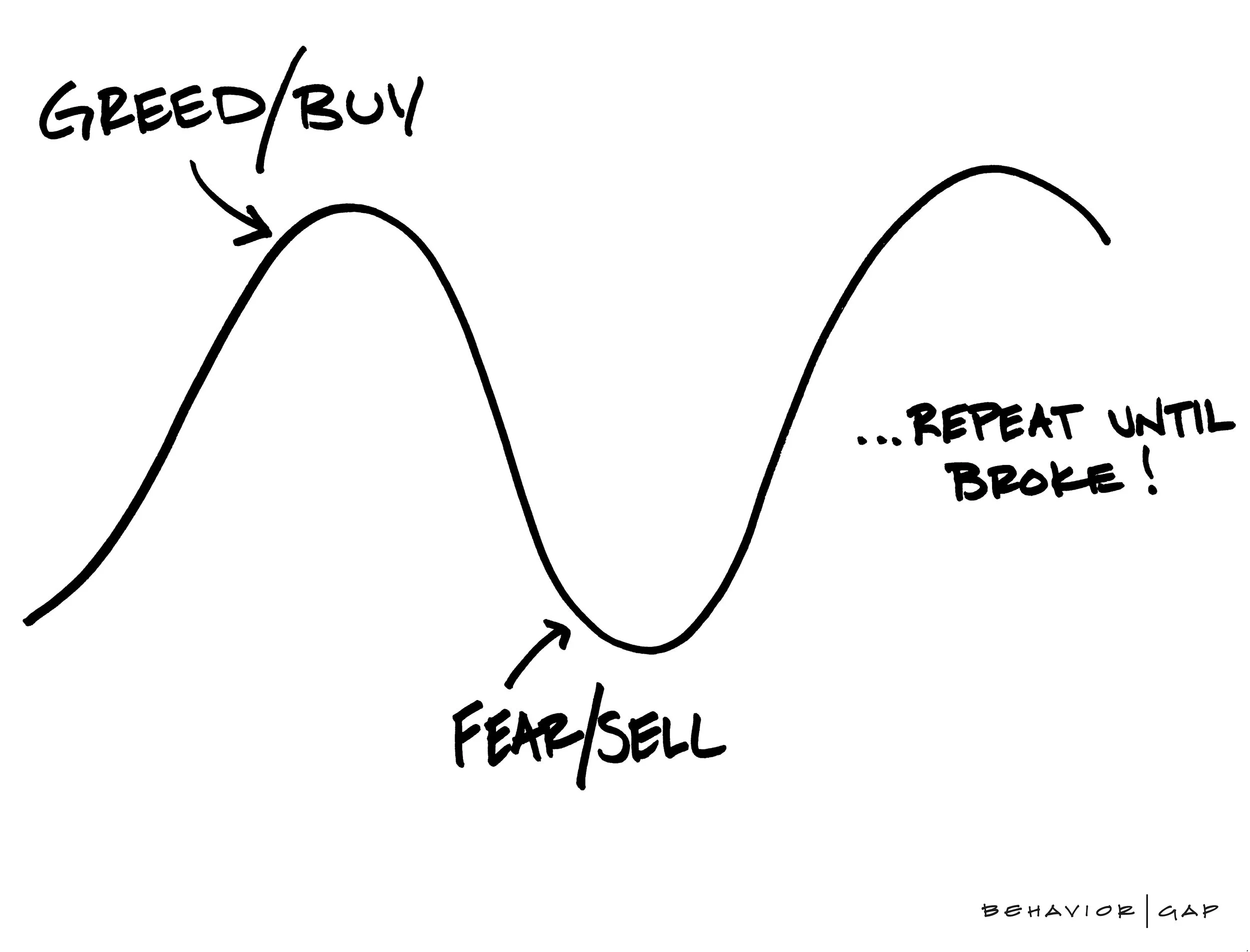

Mark-Up: Market prices tend to be stable and begin a slow climb with higher highs and higher lows. It’s still considered a bear market at this point, but more and more people are seeing that the worst may be over and are stricken by greed and fear of missing out and get back into the market for a bit higher price than those who bought in during the last phase. As the mark-up phase continues, more and more people jump on the bandwagon and buy back in forgetting that they likely sold the same stocks not that long ago for far less than they’re buying them for now. Market sentiment has changed to bullish instead of bearish.

Peak: The market goes back to a mixed sentiment as some see the fall coming and are bearish while others think this ride lasts forever and remain bullish. Prices tend to level out and this phase can last as long as a year and half or as short as month, which leaves some investors scared as they try to time the market. Sellers tend to dominate the market, as they are settling for breaking even or a small loss.

Trough: This is the long ride down to the bottom and those who hold positions will see a loss in the value of their investments. As the trough deepens, many give up and sell off their stocks which acts as a signal for other investors to come in and buy.

While this may seem like I’m advocating for trying to time the market, it’s the exact opposite. These market cycles exist in every market and will show up in your investment experience, there’s pretty much no getting around that. But instead of getting caught up in the stress involved in trying to time the market it’s far better to find a strategy that you understand, believe in, and has proven worthwhile over the long term. The important thing to remember is that market cycles exist and only when we forget that fact do we run into problems. Just as markets go up, they go down, it’s the nature of markets. If you’re investing to reach future goals it’s important to remember that while your investments may lose some value in the trough, they will gain value in the mark-up phase. Even after the Great Recession in 2008, those that held on were repaid by making their money back and more just a few years later. If you take one lesson from this it’s not to fall into the trap of greed and fear and believe in the strategy you have enacted. If you have questions about when this bull market will end, ask someone else, but if you have questions about how best to position yourself so as to capture value over the long term, send me an email.