Strategic Diversification

When most people think of the stock market, what they’re thinking about is the S&P 500 index which is weighted towards larger and strictly US companies. While it does provide a good snapshot of the US economy, to say that just investing in the S&P through an index fund is all you should consider is short sighted and detrimental to your overall investment experience. With the extra volatility added by the US and China’s trade war along with other harmful trade policies, it’s useful to look at investments with broader scopes than the S&P can provide. Let’s take a deeper look into some reasons why broad diversification is helpful, especially for those who want stable returns over a long time horizon.

Broad diversification reduces the risk that one company or one sector’s performance can greatly impact your wealth. If you feel as though the tech industry is going to be leading the way in terms of returns and you invest most of your money into some of the big tech stocks like Google, Facebook, Netflix, and Amazon then you’re at a much higher risk if the market dips for whatever reason. A recent example is the huge drops in both Facebook and Netflix stocks and if they comprised a large portion of your investment portfolios you would have lost a good percentage of your assets. By spreading your assets over many sectors and industries you’re able to decrease the chances of a big negative impact on your portfolio due to the poor performance of an underperforming sector.

Many people know that timing the market is a futile effort, and that this years hot tickets may be ranked near the bottom next year. There are then people who say that picking winning stocks is useless, you need to pick the winning investment managers who pick the correct stocks. Unfortunately, the results of this strategy mimic the stock picking strategy, as most managers fluctuate in much the same way as stocks. By investing in a broad spectrum of companies, it takes much of the guesswork out of the investment experience. The pertinent theory here is that in general the market will go up despite some stocks going down in any given year. If you’re investing in as many companies as possible the goal is to capture the overall returns of the larger market and absorb any losses without throwing your investment objectives out of whack.

Maintaining a broadly diversified portfolio over many asset classes, sectors, and countries smooths out the bumps and provides for a more stable outcome. For those who feel stress and anxiety when they see the market dip, this is especially helpful. Most people are familiar with, and anxious about, the jagged lines that appear in a market report and represent the volatility that the market is experiencing. While everyone loves to see those peaks, nobody is fond of their investments falling off a cliff and losing money. By making sure that your investments are adequately spread out and diversified it will turn those jagged peaks and troughs into a much smoother line which will reduce a lot of anxiety. Investing in a strategy that reduces anxiety as well as captures market returns should be a goal of anyone who wants to have a successful investment experience, so be sure that you understand your investment strategy and feel confident that it properly handles market volatility.

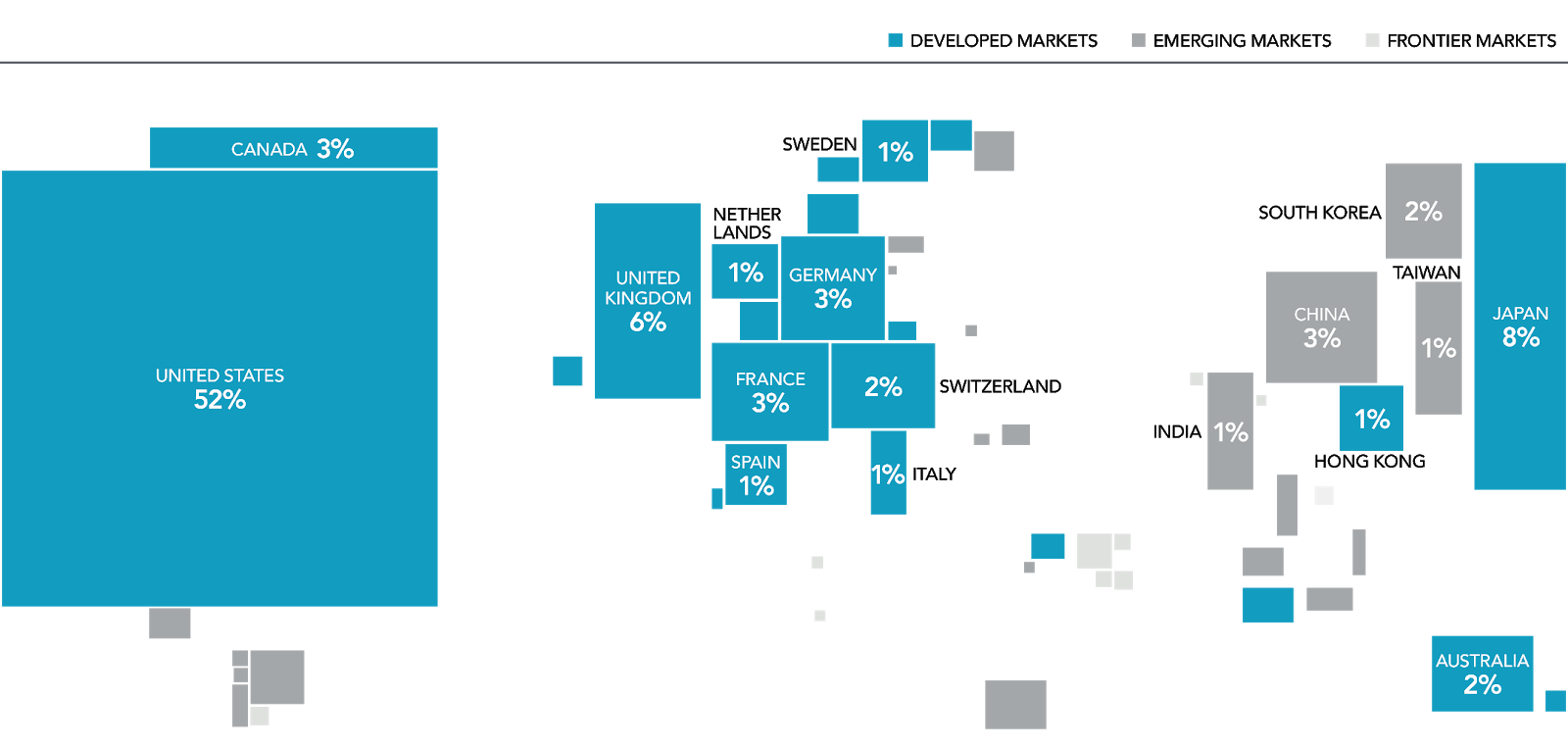

By diversifying globally, you can capture returns on your investment wherever they may occur. Just as you can never tell which companies will rise to the top in any given year, the same holds true for global markets. With this strategy, you’ll be prepared to capitalize on global returns in whichever countries they occur. Exposure to foreign investments increases the chances that your portfolio will grow in spite of any country having a down year for market returns. What most people don’t realize or conceptually understand is that while the US is the strongest single economy, it only makes up about 52% of the global equity market. That means that while domestic investments are certainly important, limiting yourself to only about half of the global equity market is unwise and could be costing you in the long run. To get a better sense of how the global equity market breaks down, here’s a graph as to how the market is broken down by country.

As you can see there are a number of opportunities in both the developed and emerging markets throughout both Europe and Asia that you close yourself off to by only investing domestically. This graph also highlights the depth to which you can diversify globally. If the US bull market starts to slow in the next year or so, having a strategy that can utilize overseas investments to make up for domestic shortfalls is a great way to have a smooth investment experience.

While most people know that investing in one or even a few stocks is needlessly risky, many people aren’t aware of the extent to which you can make sure your investments are diversified. That being said, I have nothing against domestic index funds and I believe that they can be a great piece to add to most portfolios, but I don’t want people falling into the trap of thinking that that’s all they need to do in order to have successful investments. With the benefits provided by broad diversification across asset classes and industries as well as globally, it’s no longer enough to simply park your money in an S&P index fund and hope for the best. A successful investment experience and reaching your goals requires a strategy that’s tailored to you and diversification plays a big role in making sure your investments pay off in the long run.

How diversified is your portfolio? Have you tied up most of your investment assets in a domestic index fund? If you’re curious about how you can restructure your investments to add more broad diversification across both asset classes and the global equity market, contact me and we can go through it together.